-

Many Business Interruption claims have been denied

-

Coverage fall under 'Property Coverage'

-

Pending Litigation may change the future of Interruption coverage

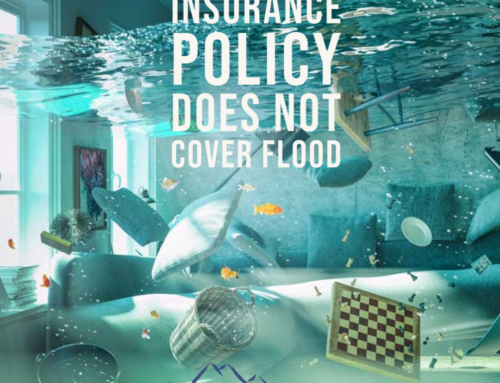

No one could have predicted the uncertainty and financial impact the Covid 19 Coronavirus has created in 2020. Many business owners start their fiscal year in January and look forward to their future earnings. This year, however, could not have been any more damaging for industries who received a direct blow from shut down orders, event cancellations and significant limitations that came with Covid 19. While some industries prospered, many business owners were greatly impacted by unfortunate economic climate that endured. As a result, several businesses turned to their commercial insurance policy in hopes of receiving business interruption coverage to remedy their finances and keep their businesses afloat. To their displeasure, business interruption claims were denied and businesses were left in the dark to navigate adverse times.

Business interruptions coverage typically falls under property coverage on a commercial insurance policy only when physical damage occurs to the property. Quite frequently there are exclusions in the policy language and viruses tend to be one of them. As a result of this misfortune, businesses around the globe have perused legal action against insurance companies over the denied claims for business interruption denials. A law article from August 2020 highlights the outcomes of these lawsuits from courts around the country who have sided with the insurance companies. Court cases in Michigan, New York, Texas and Washington, D.C, have all supported the decisions of insurance companies and their handling of Covid 19 business interruption claims. To date, there are hundreds of cases in the court system deliberating whether or not an insurance company is contractually obligated to pay out business interruption claims. While many indicators point to rulings in favor of insurance companies, it is possible for a court to rule in favor of business owners who are willing to take on the costs and time that goes with legal proceedings.

The future is unclear as to whether or not insurance companies will update their policies to add in language surrounding businesses interruption as a result of viruses, or if they will develop new additional coverages that can be purchased at an additional cost with a commercial policy. As we learn more about this we will keep our commercial clients updated on the latest coverages.

Reference:

https://www.law.com/dailybusinessreview/2020/08/24/courts-find-no-coverage-for-covid-19-business-interruption-claims/?slreturn=20200830135027